Seven steps to complete a supplier selection process in GMP

- Kazi

- Last modified: March 15, 2025

GMP processing plants should create a standardised approach for the supplier selection process to make sure the right materials are available at the right time in the right quantity.

Strategic engagement with the suppliers of different item types is important, especially in today’s ‘Just-In-Time’ supply arrangements.

A typical GMP processing plant would require different supplies to maintain its operation and distribute the processed goods to satisfy market demands within an agreed lead time throughout the year.

The supplied materials may include active pharmaceutical ingredients, excipients, critical and non-critical packaging materials, printed materials, devices, laboratory supplies, engineering supplies, bulk products, imported finished goods, cleaning agents and tools, and office supplies.

The key to product quality is the risk-based supplier selection process and maintaining long-term strategic supplier relationships for the GMP site.

Table of Contents

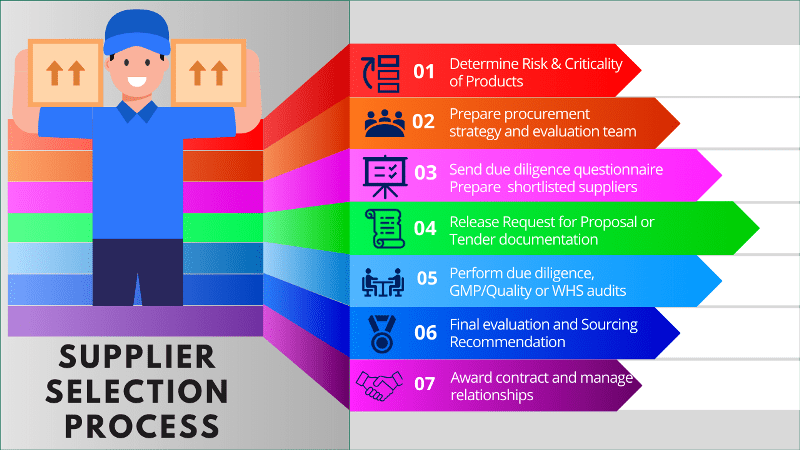

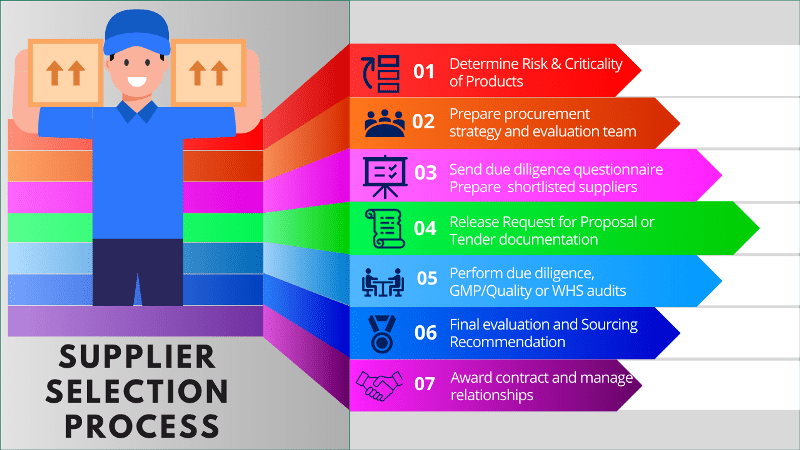

Steps involved in the supplier selection process

- Determine criticality of products

- Initiation of supplier selection

- Preliminary supplier selection

- Targeted selection activities

- Focused supplier assessment

- Final assessment and sourcing recommendation

- Supplier award and implementation

Step 1: Risk-based approach to determine the criticality of products

The critical nature of the materials being used and the potential sourcing location must be considered in a risk-based approach to define the level of activity required to complete a supplier selection process successfully.

High Risk:

These materials would have the most importance to the quality of the product.

In most cases, active pharmaceutical ingredients and contract manufacturing suppliers would fall into this category. High-risk projects are expected to follow this process in its entirety.

High-risk material examples include:

– Drug products

– Active Pharmaceutical Ingredients (API)

– Excipients for parenteral products

– Devices, including raw materials for medical devices

– Any material sourced from a high-risk location (i.e. Quality, EHS) or if part of the supply chain is in such a location

Medium Risk:

These materials would have a lower impact on the quality of the product but are associated with regulatory requirements.

In most cases, excipients and primary packaging would fall into this category. At a minimum, the tasks shown in the Supplier Selection Checklist should be performed.

Medium-risk material examples include:

– Registered starting materials

– Primary packaging

– Non-sterile excipients

– Regulated printed packaging

Low Risk:

These materials do not require a stringent supplier selection process.

However, it would be best to do the due diligence based on the risk associated with the project.

In most cases, any non-product contact materials and commodities would fall into this category.

Low-risk material examples include:

– Secondary packaging materials (unless printed)

– Tertiary and other packaging

– Other raw materials (i.e. solvents, commodities)

If a step is omitted for any reason during the selection process, the reason should be clearly documented and approved by the core team.

250 SOPs, 197 GMP Manuals, 64 Templates, 30 Training modules, 167 Forms. Additional documents are included each month. All written and updated by GMP experts. Check out sample previews. Access to exclusive content for an affordable fee.

Step 2: Initiation of supplier selection process

When a decision has been made to evaluate a new source for a material or product, the following process is recommended. The selection process can be initiated by anyone from multiple departments.

The selection process will be led by the Procurement team based on project requirements.

The Project leader will then create a list of stakeholders and assemble an evaluation committee or selection team.

The core team may be part of the central or regional functions and will include the following departments:

– Procurement

– Quality Operations

– Employee Work, Health and Safety

– Production Operations

– Regulatory Compliance

As dictated by project demands, the team may also consist of members of the following departments as required:

– Supply Chain Management

– Packaging Services

– Marketing

– Research and Development

– Project Manager / Team Leader

– Product Manager

– Legal support

– Finance Representative

The selection team members will review the project and agree on deliverables with a timeline (schedule) for the selection process.

They will identify business requirements, market structure, spending analysis, supply chain information, specification, procurement method and any additional necessary information.

The team is responsible for developing a Preliminary Proposal Packet that will be sent to the first round of suppliers.

A pool of potential suppliers is generated by the team. Generally, information should be asked for from two or more suppliers to ensure there’s a good fit.

Competitive bidding is the process used to ensure that the prices paid for goods and services purchased are fair and reasonable.

Whenever possible, you’ll need to submit the request for information, proposal or quotation in writing to potential suppliers. Just so you know, supplier responses should also be received in writing.

Exemptions from the competitive bidding

The following exemptions from the competitive bidding process require that documentation be kept (paper or electronically) with the selection process Team Leader and the contract or purchase order file:

– Goods or services that are provided by strategic suppliers during the life of the contract. All agreements with strategic suppliers must be competitively bid upon expiration.

– Goods or services that can be defined as a verifiable extension of work previously awarded on a competitive bid within the duration of the base project.

– Goods or services that have been formally established in writing as a business standard.

– Goods or services that are required in an emergency to maintain/repair facilities and equipment critical to routine operations and/or necessary to correct severe Environmental Health and Materials required to deal with safety hazards or regulatory concerns.

– Goods are in extremely short supply due to critical raw materials, packaging shortages, or other market conditions.

– Goods and Services purchased from sole-source suppliers

If a purchase is not exempt from competitive bidding and the team determines that bidding is not appropriate for the purchase, the reasons for waiving bidding should be documented and approved in writing by the Procurement manager before proceeding with the purchase and kept by the Team Leader and in the contract or purchase order file.

A suitable agreement (i.e. Confidentiality Disclosure Agreement or Master Services Agreement) must be executed before any proprietary information is discussed or given to the proposed supplier. If a suitable agreement already exists, it may need to be amended to cover the specific opportunity being assessed.

Potential suppliers in the external market are identified, and a Request for Information (RFI) is sent, including a preliminary project packet.

At this point, supplier expectation needs to be tempered by providing an overview of the evaluation process:

– Procurement stages (i.e. initial screening, complete evaluation),

– Expected timing (2 months, then 6-12 months) and

– Potential outcomes (not selected, successful supplier)

Step 3: Preliminary supplier selection

When sufficient information has been gathered, the team performs a preliminary supplier assessment. Topics may include:

– Commercial

– Supplier Financial Analysis

– Business Model

– Legal

– Quality

– Technical

– Timelines

This information may come from internal and external sources.

a) Red flags may come from the supplier’s website and presentation (no obvious business conflicts / Intellectual Property concerns) or inappropriate internal contacts (Conflict of Interests)

b) The supplier is asked to provide date-stamped photographs of key supplier areas (i.e. manufacturing area, drying area, raw material and finished goods warehouses, QC and development labs) that would be used to support the project.

Potential suppliers not meeting the minimum requirements should be eliminated from consideration, and the reasons for this should be documented.

250 SOPs, 197 GMP Manuals, 64 Templates, 30 Training modules, 167 Forms. Additional documents are included each month. All written and updated by GMP experts. Check out sample previews. Access to exclusive content for an affordable fee.

Step 4: Targeted supplier selection activities

The targeted suppliers should now be sent a Due Diligence questionnaires, which involve:

– Quality,

– EHS

– Chemical or Regulatory Status

– Condition of bidding

– Core Contract Terms

– List of basic quality expectations or draft Quality Agreement

– Foreign Corrupt Practices Act (FCPA)

The aim of the questionnaire is to establish minimum expectations of doing business.

So that you know, compliance and agreement with these documents will be used for further selection.

The legal team should evaluate the potential suppliers for any project termination conflicts. A pre-screening visit can be coordinated by the Procurement or another suitable representative, if appropriate, based upon prior business experience or technical need.

a) A new supplier with no earlier experience or an existing supplier with limited experience would require a site visit to confirm acceptability & specific capabilities.

b) Existing suppliers with extensive experience or with comparable projects would not require a site visit. However, a visit may be needed based on risk and the date of the last on-site visit.

After further information and documentation have been received, the team performs a second prequalification screening; topics may include:

– Cost

– Capability

– Capacity

– Business Risk

– Quality

– Regulatory Compliance

Potential suppliers not meeting the minimum requirements should be eliminated from consideration, and the reasons should be documented. The team should prepare and send a detailed project packet to the remaining suppliers.

Step 5: Focused supplier assessment

A preliminary Request for Proposal (RFP) or Request for Quotation (RFQ), including a detailed project packet, is sent to the focused list of suitable suppliers.

They will be requested to provide a commercial proposal based on this package and the business supply requirements.

The suppliers must provide their quotation per the team’s agreed-upon timing. If determined necessary, formal due diligence, GMP / Quality EHS, and warehouse audits should be performed.

If this step is not deemed necessary, the reason for not performing audits must be formally documented. The audit should be scheduled appropriately so other relevant departments may join.

Once the audits have been completed, the results and any supplier comments or action items will be presented to the team.

If the actions are not deemed satisfactory, the supplier should be removed from consideration, and the reasons should be documented.

With the audit reports and detailed quotation, the team should evaluate the following items to determine suitability for business needs.

– The Supplier’s process

– The Supplier’s entire supply chain from the point of manufacture/origin to the delivery location

– Specifications

– Quality systems

– Regulatory Status

– EHS conditions

If no critical issues are identified, all remaining suppliers will be deemed suitable for qualification.

250 SOPs, 197 GMP Manuals, 64 Templates, 30 Training modules, 167 Forms. Additional documents are included each month. All written and updated by GMP experts. Check out sample previews. Access to exclusive content for an affordable fee.

Step 6: Final supplier assessment and sourcing recommendation

The remaining suppliers will request a final bid and samples for any required chemical, physical or performance testing if necessary.

The core selection team must confirm the need for exemptions or registrations for sending samples between countries.

In addition, at this time, the core selection team should evaluate and confirm the compliance status of suppliers and supplier products with multi-national chemical regulations that regulate the activities of manufacturing, importing and placing chemical substances, preparations and articles onto the market.

The Supplier should confirm that the chemical substances used in regulated activities are excluded, exempted or registered for their intended use.

Once the samples have been evaluated, the team will perform a final impact assessment including:

– Regulatory

– Material performs as expected in the required process

– Stability

– Technical risk

– Supplier compliance with applicable laws and regulations

– Complexity assessment

– True cost of quality

– Total cost of the project

For situations where materials are purchased through a broker, the actual place of manufacture must be established, or this supplier should be removed from consideration.

Where a broker is still under consideration, each ‘hand-off’ point in the supply chain should be documented and understood, and the process for demonstrating the ‘pedigree’ of the material from manufacture to delivery should be understood and documented.

The cost of quality should be evaluated for each supplier selection process, and this cost needs to be included in the financial assessment of the product so that a “full and true cost of material” can be established and to highlight the risk of selecting a particular supplier.

The cost of quality highlights the cost of risk mitigation as part of the Supplier assessment and implementation.

It is divided into two main elements: conformance and non-conformance.

– Conformance includes all costs associated with continued assurance that the product conforms to specifications and is manufactured under appropriate controls (i.e. person-in-plant, surveillance and release testing, supplier education on quality requirements).

– Non-conformance includes the resources expended to return, evaluate and correct a product or a supplier practice that deviates from acceptability (i.e. impact on product and company image, complaint handling and product investigation, corrective action costs, legal fees or compensation to victims).

The supplier-rating document may be employed to drive differentiation amongst suppliers.

Potential suppliers not meeting business/project requirements should be eliminated from consideration, and the reasons should be documented.

This evaluation will generate a preferred supplier(s) for endorsement.

Step 7: Supplier award and implementation

After receiving the endorsement, the team will inform the selected supplier in writing about the business award.

The other candidates who have not been selected will also be notified, and if necessary, the Team Leader will request all materials be returned appropriately to the principal business.

The team will notify the appropriate personnel and sites of the decision. The team leader will be required to keep all relevant documentation a recommended list of items is:

– List of team members

– Suppliers evaluated and the reason they were removed from consideration

– The Supplier comparison table

– Justification for preferred candidate

– Copy of the quotations provided by the Suppliers

Conclusion

The supplier selection process on the GMP site should be robust and consistent.

Suitable suppliers with high-performance levels are essential for ensuring product safety, quality, and cost management for the business.

GMP sites have to maintain approved supplier lists that are subjected to a rigorous selection process and a periodic review process.

Strategic relationships should be developed with suppliers for high-value and critical components to ensure long-term value and benefit for both customer and supplier.

This supplier selection process described above provides a flexible model that allows changes or omission of steps based on the type of material, business history/experience with proposed suppliers, and cultural or regional differences.

However, any deviation from the process should be appropriately documented and retained.

Author: Kazi Hasan

Kazi is a seasoned pharmaceutical industry professional with over 20 years of experience specializing in production operations, quality management, and process validation.

Kazi has worked with several global pharmaceutical companies to streamline production processes, ensure product quality, and validate operations complying with international regulatory standards and best practices.

Kazi holds several pharmaceutical industry certifications including post-graduate degrees in Engineering Management and Business Administration.

Hi outstanding blog! Does running a blog similar to this take

a lot of work? I’ve absolutely no understanding of coding but I had been hoping to

start my own blog soon. Anyways, should you have any recommendations or techniques for

new blog owners please share. I know this is off topic but I simply wanted to ask.

Thanks a lot!